Options Trading Fund

Our Goal is 1% per week To Investors

An alternative investment fund built to grow your wealth through compounding returns or monthly cashflow. Your money, your choice.

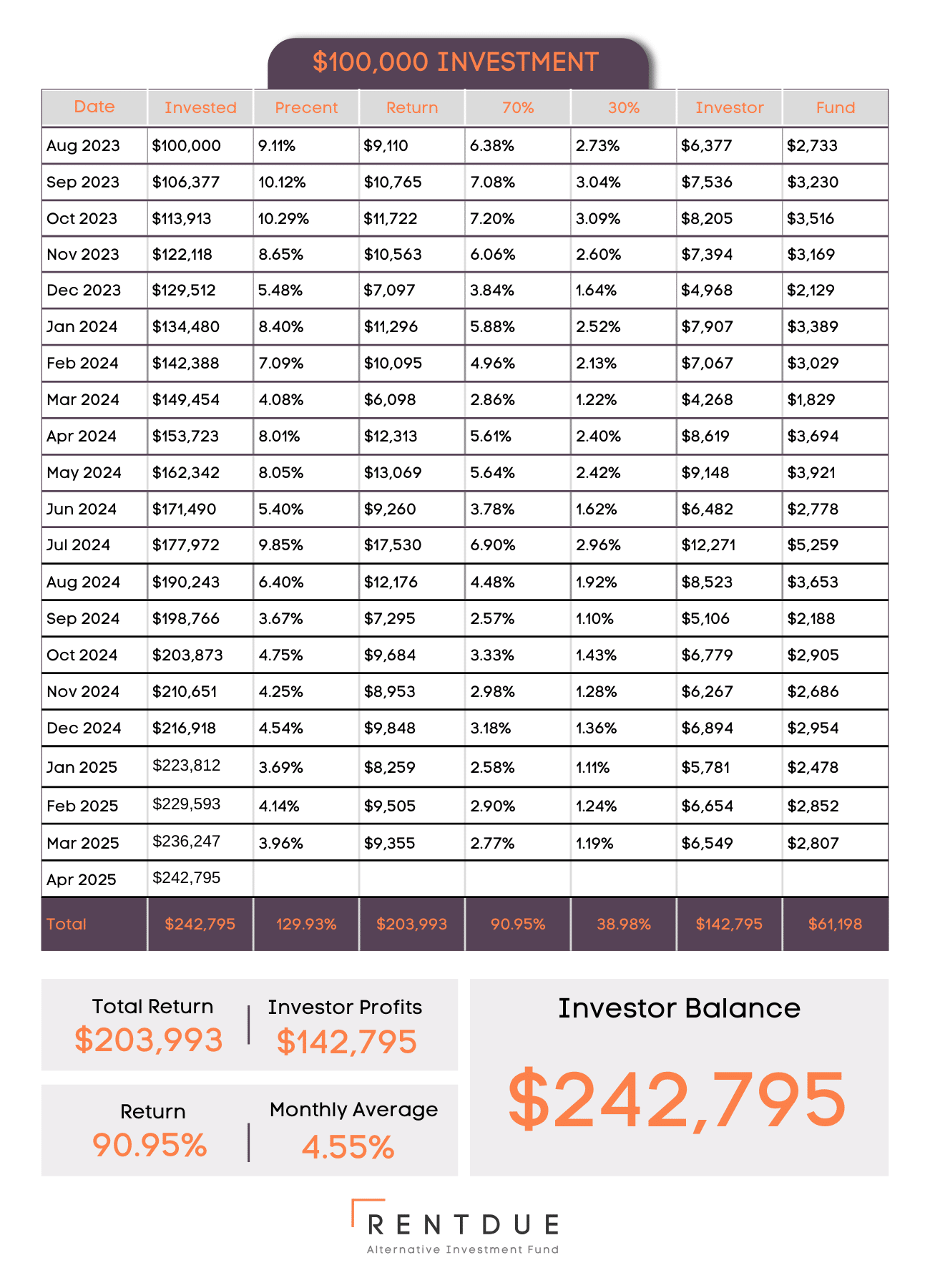

Growth of $100K August 2023

From August 2023 to July 2025 | View disclosures

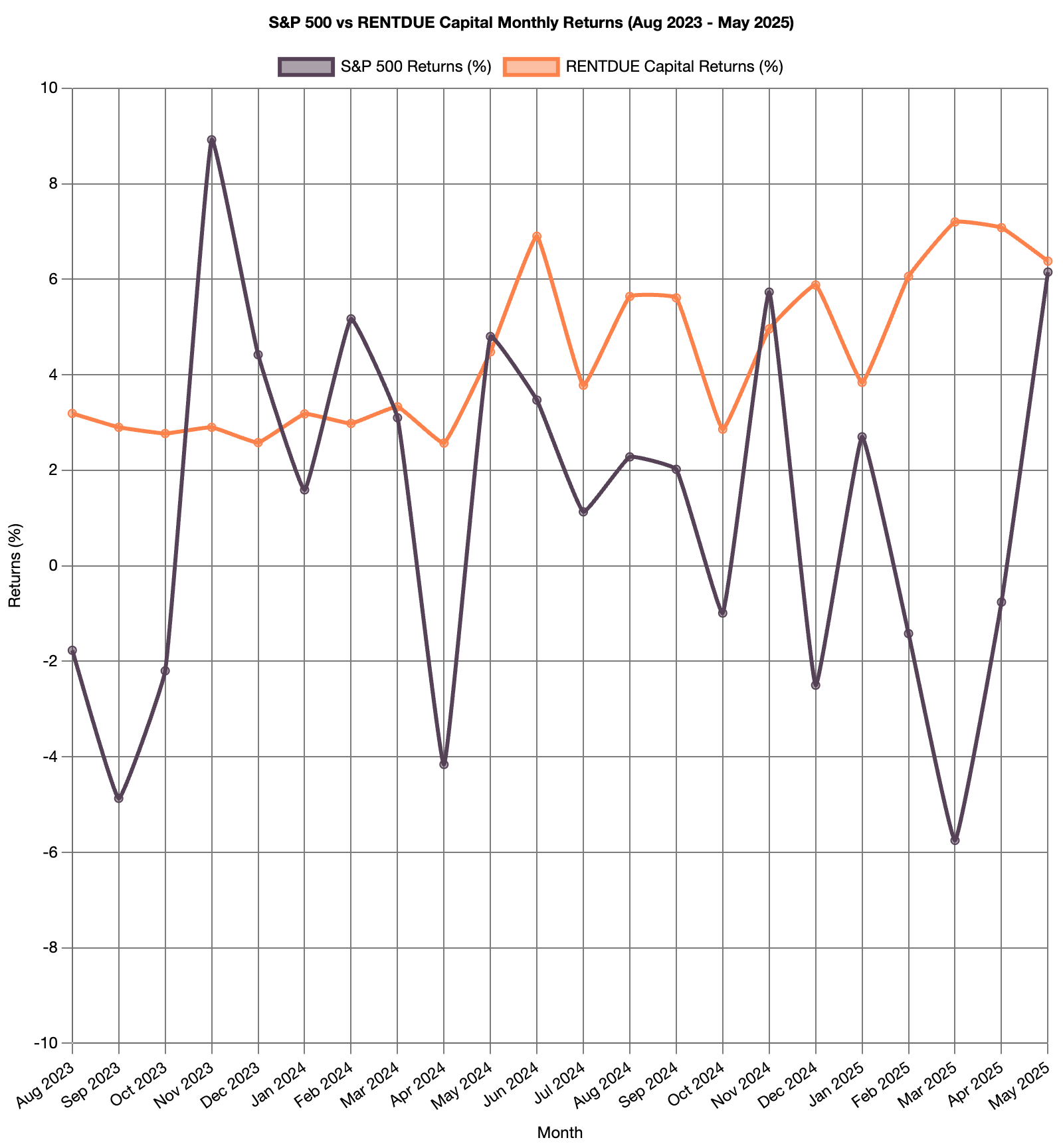

Averaging 4.34% per month

Why Invest With RENTDUE?

RENTDUE Capital’s strategy is about achieving high returns through disciplined options trading and maintaining liquidity so you have access to your money. Review our current funds to see if RENTDUE Capital is a suitable addition to your portfolio.

Never in the dark

Weekly sms updates!

Keeping you informed is a top priority. That’s why we send weekly text updates with the latest performance details from your portfolio.

RENTDUE vs S&P

Zero losing weeks

Since August 2023, RENTDUE Capital hasn’t had a single losing week or month. In contrast, the S&P 500 has posted 8 losing months over the same period.

Grow your Money

$100,000K

A $100,000 investment in RENTDUE just 22 months ago would be worth over $250,000 today. Ask yourself—where else are you seeing returns like that?

We are growing

Explore our Different Funds!

“Compound” FUND 2

High returns through disciplined options trading and maintaining liquidity so you have access to your money.

Goal: 1% per week

Compound or Quarterly Draws

Fully Liquid

“CASHFLOW” FUND 3

Created for cashflow! Investors receive an 18% annual preferred return, distributed in monthly payouts. No Compounding!

1.5% Preferred Monthly Return

Monthly Cashflow

Fully Liquid

CLOSED: RENTDUE FUND 1

FUND 1 is now closed. It was over subscribed and due to SEC Regulations we have to cap the number of investors. Current investors can continue to add to their account.

Alternative Investing

Try Something That Actually Grows

Options allow you to tailor risk and return through various strategies—from hedging to leveraging gains—without the need for large capital outlays.

High Growth

Our goal is 1% return on your capital every week. When you compound your investment every week, your money doubles quickly.

Cash Flow

RENTDUE can provide you with cashflow. Some investors like to pull their interest every quarter. Last year $100,000 would have paid you $15,000+ every quarter.

Benefits of options trading

Our tRACK RECORD

Our track record has been outstanding, and we invite you to review it. If you want to see the last years performance, click on the link below and complete the form, you will receive access to our daily profit updates and the performance history of our current fund.

RENTDUE Capital Fund 2 and 3

RENTDUE is set up as an LLC. When you invest, you become a member. By becoming a member of the LLC, you will receive a K-1 form for tax purposes. The LLC provides a combination of flexibility, tax benefits, and asset protection. Learn More

Do you have questions? Ask the bot.

We have created a CHATGPT that can answer almost any question about RENTDUE. Click on the link and start asking questions.

Our Approach To Risk

Taking calculated risks is essential for achieving significant returns in the investment world. At RENTDUE Capital, our primary objective is to preserve capital while pursuing high returns, embodying the philosophy of Warren Buffett. Our track record speaks for itself: since we began tracking in August 2023, we have experienced only 20 losing days. Notably, in Q4 of 2024 and Q1 of 2025 we had just 1 losing day per quarter. While risk is an inherent part of investing, our disciplined approach and proven strategies provide our investors with a sense of security and confidence in our ability to manage and minimize losses effectively. We believe that the biggest risk, is not taking any risk at all.

Fund Size

56 Million

Total ProfitS

$14,728,221.60

Management Fee

3o/70

12 Month Return

148%

Total Investors

153+

Weekly Goal

1%

Total Losses

-$177,539

**Statistics numbers are from August 2023 to March 2025**

Running Track Record

If you invested $100,000 intO RENTDUE 20 months ago, where would you be today?

In August 2023, a $100,000 investment in RENTDUE Capital would have grown to $223,812 by the end December 2024. Here’s the detailed breakdown:

Compounding

Reinvesting your funds and allowing them to compound would have generated a gain of $123,812, resulting in a final balance of $223,812.

Cash Flow

RENTDUE CAPITAL QUARTERLY REPORTS AND NUMBERS

Want to see how we perform? Click the link to read our quarterly reports, view our full track record, and dive into weekly updates with all the numbers behind RENTDUE Capital.

GUIDE TO CONVERTING YOUR 401K/IRA TO ALTERNATIVE INVESTMENTS

Let’s face it, Wall Street loves your money almost as much as they love taking a slice of it every time your money is deposited into your 401K. Whether the market goes up or down, they win, raking in fees like a croupier at a casino.

General Manager Questions

Do you invest your own money?

Yes, I have the largest stake in the fund, which means I stand to gain the most—and potentially lose the most. I plan to keep it that way.

How much money do you make?

The investor get 70% of the profits and Rentdue gets 30%.

Why did you start Rentdue Capital?

I was hesitant to dive back into the fund game, but watching so many struggle to get a return ignited that ever-present feeling that I needed to do this. So, here I am, jumping back in and raising investment money.

Back in 2008, I lost all my financial wealth. But it wasn’t just me who took the hit—people who trusted me with their money also lost a lot. I hated it. I don’t think I slept for a year. Even though they knew the risks, I felt like I had let everyone down. It still hurts.

I licked my wounds and got back into investing, but this time is different.

Money is a doubles game, and I’ve doubled my money countless times over. Now I want to do it for others.

What did you do before?

My main goal is to be happy and keep life simple. Here’s the game I like to play. I start new businesses and grow them with my marketing company (RED). I take the cash from those businesses and buy assets that produce more cash flow. (RENTDUE Capital) I try to stay humble and grateful during the process. I do have my MBA degree from SUU, but my real degree comes from having “skin in the game.”

Here’s my timeline:

2004: Launched A Lending Company and made some great money. Learned the law of the harvest.

2004 – 2008: Invested in FOREX, Land, Apartments, Stocks, and did Hard Money loans. Had no idea that corrections happen. Winter always comes after summer! How often? Always!

2008 – 2011: Lost everything and endured the 2008 financial crisis. Went from 6 million net worth to a negative 3 million net worth. Amazing time! Went back to work and read 150 business books. Got my Masters in Business from SUU.

2011: Started Ydraw with a Childhood Friend. We created whiteboard animation videos and started that industry in the USA. It was the right product at the right time. Launched us into the inc 5000. Put off a huge amount of cashflow. It’s still going! (kind of)

2012: Started RED; a marketing company that helps business grow. We take care of everything Lead Gen so the business owners can focus on closing deals and making their product or services better.

2012 – Present: Started investing again in Hard Money, and Real estate. I had an expensive education in 2008 so now…I buy Cashflow. Goal is 100 units per year.

2021 – Present: Started All Out Dental. Started ERTH Wellness. Started and now manage RENTDUE Capital

There really was no end game to what I am doing. I just take life 1 day at a time and stay happy. I’ve made poor decisions and I have made some good ones.

RENTDUE Rule 506c of Reg D

SEC Rule 506c, enacted in 2012, is part of Regulation D, allowing businesses to raise capital from private investors without registering the offering with the SEC, while permitting advertising and general solicitation. This rule enables issuers to raise unlimited funds from an unlimited number of accredited investors, provided they verify the investors’ accredited status and ensure all necessary information is disclosed accurately. While Rule 506c offers significant advantages, such as the ability to broadly market securities, it requires strict compliance with investor verification and disclosure requirements. We only accept accredited investors. Learn more

See our Daily Numbers

Are you ready to JOIN US!

We would be delighted to have you join us; however, we exclusively accept accredited investors. If you're ready to invest, please click the link and complete the form. Should you have any questions, feel free to contact us.