Introduction:

Q3 2024 is in the books, and what a quarter it was! We hit some big milestones, welcomed new investors, and kept our focus steady on the two things that matter most—growing your money and managing risk. As we continue to scale, we’re seeing the benefits of our disciplined approach paying off.

Our mission? High returns, liquidity, and full transparency. Let’s get into the details.

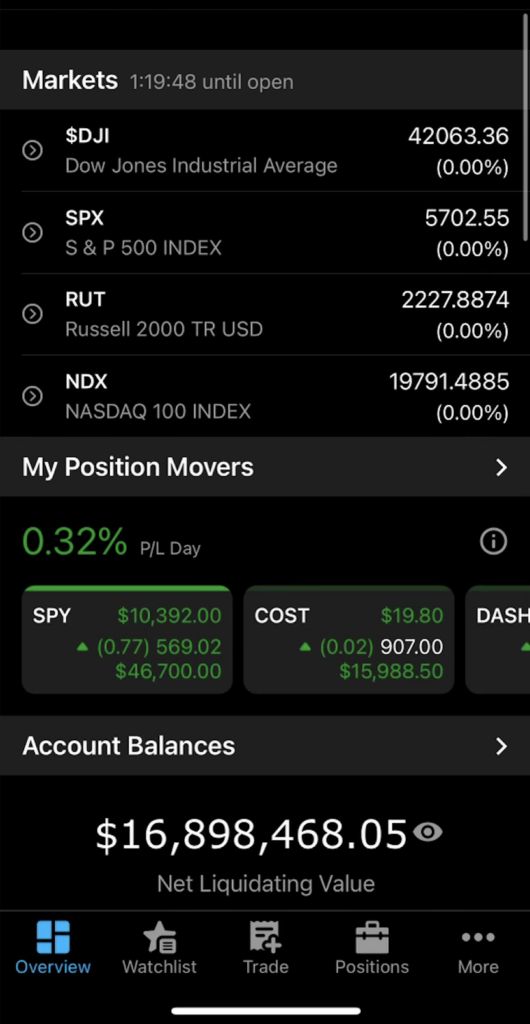

Current Fund Account Numbers

Here’s where we stand at the close of Q3:

- TD/Charles Schwab Account Balance: $16,898,468

- RENTDUE Capital Fund 1: $13,305,843

- Total Investor Funds: $7,303,475

- RENTDUE LLC (Fund Manager): $6,002,368.20

- Total Investor Interest Earned (After Fees): $584,574.51

- Total Number of Investors: 31

- Total Withdrawals in Q3: -$22,836.30

Solid growth all around, and we’re excited to keep that momentum rolling into Q4!

Performance Highlights

Q3 was a winner. Here are the highlights:

- Total Losing Days: 1 (July 19, 2024)

- Total Winning Days: 57

- Total Winning Day Streak: 44

- Biggest Losing Day: -0.18% (-$13,866.00)

- Biggest Winning Day: 1.06% (+$79,016.22)

- Q3 Total Losses: -$13,866.00

- Q3 Total Profits: $1,735,912.83

- Q3 Interest To Investors: 13.4%

One losing day out of 58? Not bad at all. Plus, we kept the loss small.

Our Lowest Performing Month

Trading requires extreme discipline, patience, and focus, and stepping away from the markets allows us to reset and come back sharper.

In September we experienced our lowest month as far as returns. One of the factors was the fact that we did not trade the final week of September. It was time for a vacation. While taking time off comes with a clear opportunity cost for both investors and the fund, it’s a necessary part of maintaining our long-term success.

During vacation time we reflect on strategy, refresh our minds, and avoid burnout. While it might mean a short-term pause in returns, it ultimately serves the long-term interests of the fund and its performance.

Compounding & The Long Game

Warren Buffett’s success is not just about his skill in investing but also the length of time he has been investing. His fortune of $143 billion is largely due to his long-term commitment to investing, with $142.5 billion of his wealth accumulating after he turned 50.

Buffett’s true “secret” is time. Had he started investing later in life or retired early, his fortune would be dramatically smaller. For example, if he had retired at 60, his net worth would only be $11.9 million—a 99.9% reduction from his actual wealth.

The comparison with Jim Simons, who compounded money at a far higher rate than Buffett (66% annually versus Buffett’s 22%), underscores that while high returns are impressive, time is the most critical factor. Simons, who started investing seriously later in life, is worth 30 billion far less than Buffett because he had less time for his returns to compound.

Think about it: if you compound $1 million at 30% for 10 years, you end up with $13.79 million. But let it ride for another 10 years, and boom—you’ve got $190 million. That’s the magic of compounding. Whether you compound your funds with RENTDUE Capital, real estate, businesses, or the stock market, the key is time.

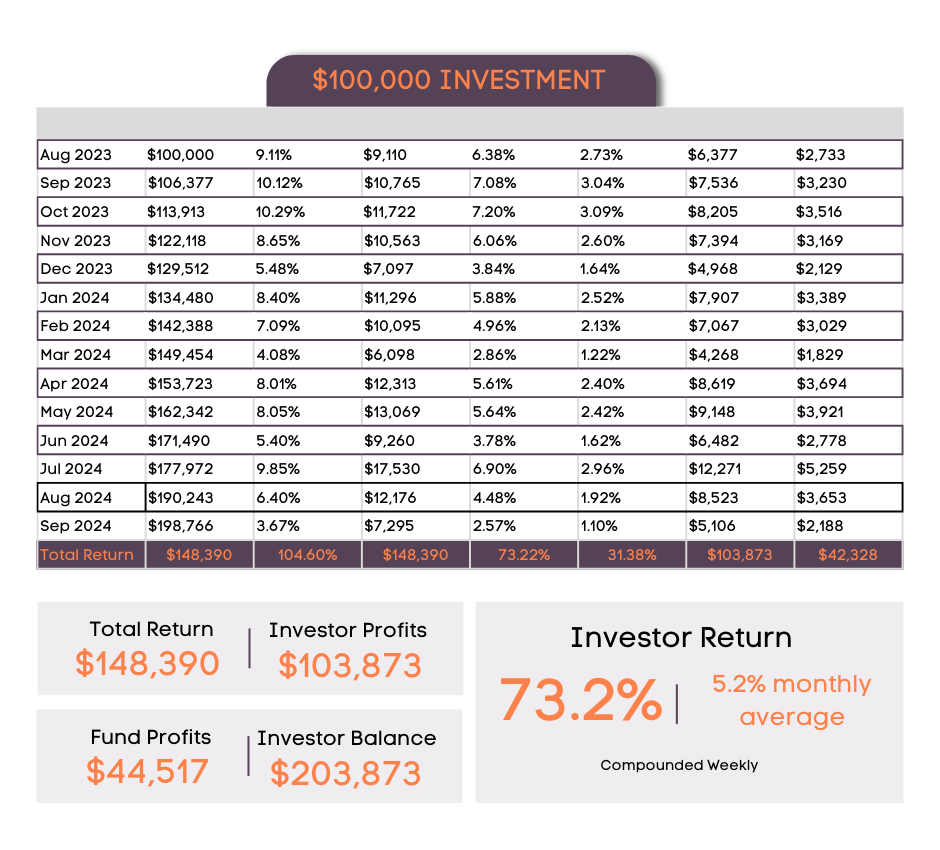

100K to 203K

The Power of Options Trading & Our Risk Profile

At RENTDUE Capital, we love options. Why? Because they give us the ability to control large amounts of stock with relatively little money, maximizing our gains while keeping the risk in check. We’re not just throwing darts here; we’re making calculated moves that offer big upside potential.

Here’s how we handle risk:

- We risk no more than 1% per trade on A+ setups, with multiple trades sometimes running at once, each capped at 1%.

- If we hit a 3% loss in a day, we pull the plug and stop trading. No chasing losses here.

- Our win rate? 80% of our trades. It’s all about playing the probabilities and sticking to the plan.

- And no, we don’t use margin or borrowed money. All our leverage comes from options, allowing us to control big positions without big capital exposure.

Outlook: What’s Ahead for Q4

With Q3 behind us, we’re gearing up for what’s traditionally the strongest stretch of the year. Historically, the NYSE Composite’s best months are April, June, July, October, November, and December. The weaker months are behind us, and we’re anticipating some great opportunities.

Our goal? We’re targeting 1% per week but expect bigger moves as we enter Q4. We’re aiming for 1.5% to 2% weekly returns as the markets heat up.

Opinion: The Dollar Isn’t Going Anywhere

Let’s take a moment to talk about the U.S. dollar. I get asked often about the economy and the potential collapse of the dollar. What will happen to the fund and how are we protected. Yes, our national spending is out of control, and inflation keeps climbing. But here’s my take—whether it’s worth much or not, I’m going to share it anyway.

The U.S. dollar isn’t going anywhere. I travel a lot, and everywhere I go, the U.S. dollar remains the strongest currency. What other fiat currency could take its place?

There isn’t one.

Try exchanging pesos in the U.S.—good luck.

The Federal Reserve’s top priority is protecting its number one asset: the U.S. dollar. They’ve toppled leaders and funded wars to do so. They’re not going to lose.

“Well, what about Bitcoin?”

What about it? The number one enemy of Bitcoin—the U.S. government—has unlimited resources. They’ve got enough Bitcoin to manipulate the markets, and if they want to squash it, they can. JP Morgan controlled the gold markets for years, and they didn’t have a fraction of the resources the U.S. government does. Bitcoin is still loaded with risk and offers zero protection. It’s not yet a place to park your savings.

For now, the Fed will keep an eye on it and let the citizens have their fun.

So what’s my prediction on the coming year?

We play the probabilities and expect next year to look a lot like this year. Opportunity mixed with difficulty.

Final Thoughts

As we wrap up Q3, we’re excited about what’s to come. RENTDUE Capital is in a strong position, and we’re ready to keep delivering solid returns while managing risk. Thank you for being part of the journey with us—here’s to a successful Q4!

Jace Vernon

Fund Manager, RENTDUE Capital