RENTDUE Capital Quarter 2 2025 Report

Another good quarter

Another quarter in the books. And a good one at that.

While Wall Street’s been swinging like a pendulum, we’ve kept our head down and kept stacking wins. Q2 2025 delivered a solid +12.77% return for the fund, and +8.94% net to investors. We had zero losing weeks, just two small red days, and added a record number of new investors.

We’ll break it all down below.

But first, a thank you. Thank you for your trust.

Overview

The first quarter of 2025 marked another strong period of disciplined growth and consistent performance for RENTDUE Capital. As of March 31, 2025, the Fund has grown to $41,325,293 in assets under management (AUM), representing a diverse base of 115 accredited investors.

Our objective remains unchanged: generate 1% per week through high-probability options trading setups, while maintaining strict risk controls, transparency, and capital liquidity. In Q1, we successfully executed this mission, with continued zero losing weeks and high consistency in trade outcomes.

Q2 2025 Performance Summary

- Quarterly Return: +12.77%

- Net Investor Return: +8.94%

- Average Daily Gain: $102,919

- Highest Daily Gain: $196,488

- Only Losing Day: -$37,467

- Losing Weeks: Zero

- Total Quarterly Gains: $6,689,725

- Trading Days in Q2: 65

Since day one, the goal has been consistency. And we stuck to it. A choppy market, news-driven price action, and light volume made it a tougher environment—but our strategy performed well.

Fund Growth

The growth this quarter was exceptional:

- AUM Across Funds: $64,623,717

- Total Number of Investors: 170

- Current Principal Deposits: $45,488,036.13

- Total Profits & Principal Owed to Investors: $51,495,664.25

- Withdrawals This Quarter: -$4,746,609.15

*this numbers do not include the fund managers. Investors first!*

We also launched two new funds:

FUND 2 (identical to Fund 1, targeting 1% per week, weekly compounding)

FUND 3 – Cashflow (monthly payouts with an 18% preferred return)

Fund 1 is now closed to new investors, but existing partners may still add capital or withdraw per the timeline.

The Power of Compounding & Our Weekly Target

RENTDUE’s strategy is built on simple math: aim for 1% weekly. This is still our goal. We have fallen short the last couple quarters. Weekly compounding may get us there.

1% per week = 67.71% annual return

0.70% per week = 44.06% annual return

We’re stacking singles and compounding. The more conservative approach has lowered our returns, but kept us in the green. No drawdowns means you’re not wasting time getting back to breakeven.

We will continue to shoot for the 1%, but be content with consistency when we fall short. We created a simple calculator that you can play with.

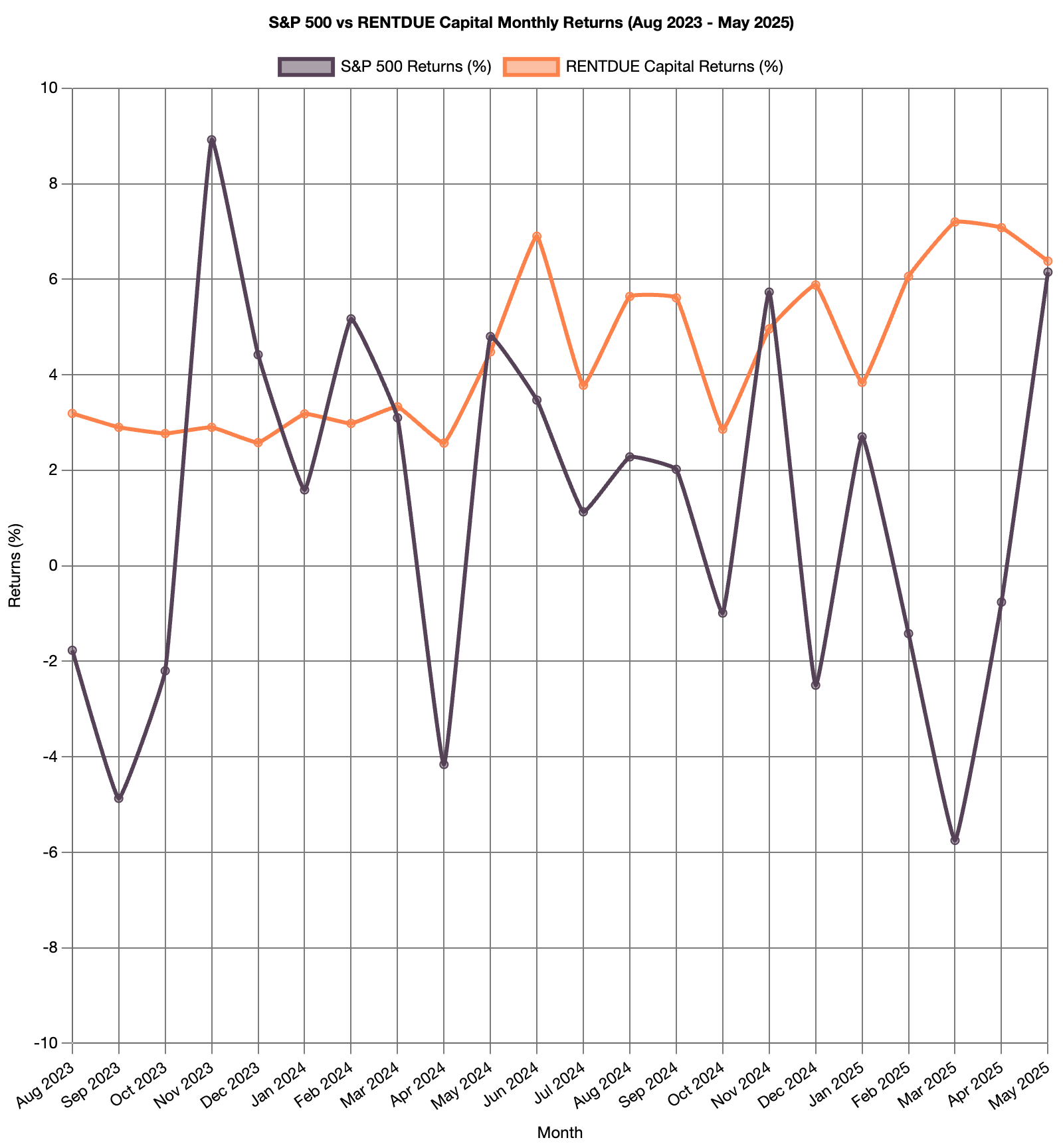

S&P 500 vs RENTDUE

Over the past 22 months, the S&P 500 has been on a wild ride—up one month, down the next, barely moving the one after. And yet, here’s the reality check: 92% of actively managed portfolios underperform the S&P 500.

Let that sink in. If you’re working with a financial advisor, there’s only an 8% chance your portfolio is even keeping pace with the index. Odds are, it’s doing worse.

And here’s the kicker:

The S&P 500 has returned just 0.92% so far in 2025.

That means a lot of portfolios are doing less than that.

Now compare that with RENTDUE:

+15.02% over the same period.

Zero drawdowns. No red weeks.

Here’s why that matters:

- Lose 10%, and you need 11.1% to break even.

- Lose 50%, and you need 100% to claw your way back.

Drawdowns are wealth killers. At RENTDUE, we stay focused on staying green—because avoiding losses is just as important as making gains.

Below are 2 images that compare RENTDUE to the S&P 500. We are doing ok!

Investor Updates, Wires & Withdrawal Timelines

We now manage capital for 170 investors. That means tighter processes to keep everything smooth.

Withdrawals:

Request must be submitted before Friday at quarter end

RENTDUE initiates withdrawal from Schwab on Friday/Monday morning after funds have settled.

Schwab wires the funds (usually early the following week)

RENTDUE sends investor wires the next Friday.

The entire process can take up to 7 days. We’ll always try to accommodate if it’s urgent—but please don’t abuse it. This structure helps us protect all investors and trade efficiently.

Fraud Warning & New Security Protocols

Scams are getting better—and more dangerous.

A few years ago, my own wife got scammed for $3,000 in a gift card scheme. They had personal info, acted like investigators, and created so much pressure that she didn’t even realize it until it was too late.

Just last week I heard about a family that lost $300,000 after someone impersonated Wells Fargo and convinced them to “help” in an investigation. These scams are elaborate and prey on emotions, confusion, and urgency.

That’s why we’re implementing new protocols:

1. Wire-in Instructions will always come with the Mountain America Credit Union logo. If you’re unsure, call me directly.

2. I will never call, email, or text asking for for money. Ever!

3. For withdrawals, you or your bank must send us wire instructions on their letterhead, and you must also complete the wire section on our form. This double verification helps protect all of us.

If you’re 50+, you’re statistically at higher risk of being targeted. Please stay alert.

If anything seems off, call me or text me.

Final Thoughts: I Have Made Mistakes

Here’s the truth: I’ve lost money before. Back in the day, a groups of guys got together and we invested in a foreign exchange fund that got crushed during the 2008 meltdown. I was the one in charge. It was devastating. People got hurt. I got hurt.

In fact, I lost more money than anyone else in the fund. And yeah—one investor went rogue and posted things online that were flat-out false, hoping to cause more damage or gain leverage. He contacted every agency because he could not afford to lose money. He was using blackmail tactics.

It was ugly and I told myself I would not get back into the fund business. We lost money and there is nothing worse than letting people down.

When I saw how good Shane was at trading, I couldn’t shake the idea of building a real fund. Sure, we could’ve kept it to ourselves and made plenty—but I figured, why not get rich and bring others along for the ride?

RENTDUE exists because of that failure—not in spite of it.

We don’t trade forex. We don’t use leverage. Every dollar is held at Charles Schwab, in the U.S., which we show the statement of balance. We risk 1% per trade. We’ve had zero losing weeks since launch. We share our performance weekly. And if you ever want to talk to current investors, just ask—we’re happy to make the connection.

At the end of the day, I know that trust is earned. So thank you for giving me the chance to earn yours. I hope none of you are using your food money to invest! There is still risk in options.

If you ever have questions—about the past, the present, or where we’re heading—my line is always open.

Here’s to the next quarter.