RENTDUE Capital is an options trading fund that delivers consistent weekly returns for accredited investors. We focus on managing risk, keeping your funds liquid, and compounding gains over time. Our mission is simple: high returns, liquidity, and full transparency.

Fund Numbers

Fund Size

45 Million

Total ProfitS

$11,793,771

Management Fee

3o/70

12 Month Return

148%

Total Investors

127

Weekly Goal

1%

Total Losses

-$177,539

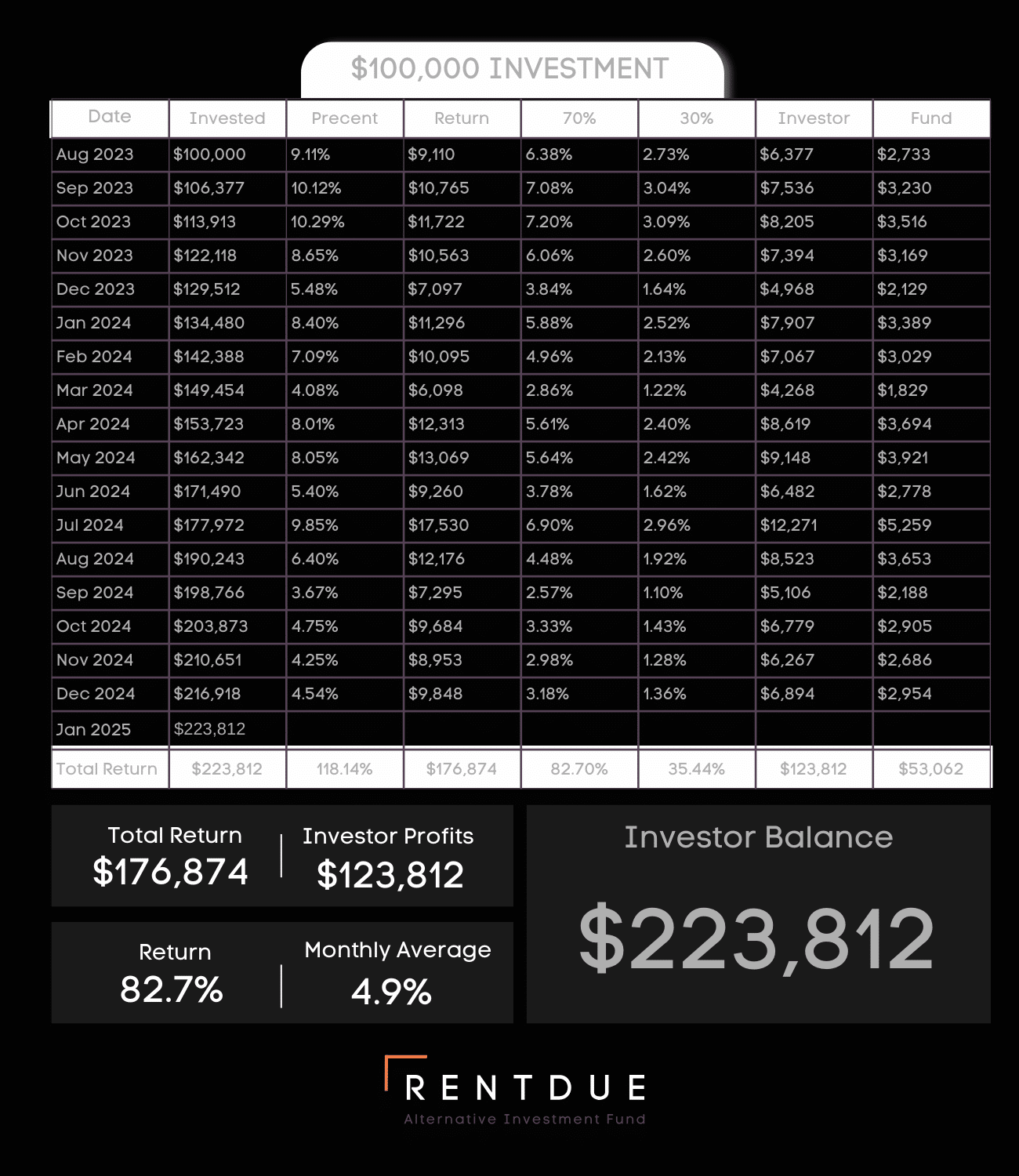

Proof It Works

Starting Amount

$100,000

17 Months Later

$223,813

Profit Per Month

$7,235

Monthly Return

4.9%

Losing Days

19

Access to Funds

Everything you should know about RENTDUE Capital

We created a series of videos to help future investors learn more about RENTDUE Capital.

Keep your funds liquid

Take Quarterly Cashflow

If you need income or wish to recoup your initial principal, you can opt in for quarterly cash flow. At RENTDUE Capital, we provide you with that flexibility.

Regulation

Regulation D under Rule (506c)

Our flagship fund, RENTDUE Capital Fund 1, is structured as a Limited Liability Company (LLC) under REG D rule (506c) provide our investors with maximum flexibility, tax efficiency, and protection.

REGULATION D

RULE (506C)

Regulation D Rule 506c is a powerful exemption that lets companies raise unlimited funds from an unlimited number of accredited investors, all while being able to advertise their offering publicly.

Risk Profile

RENTDUE Risk Profile Strategy

How risky is your investment? In this video I am going to explain to you how we look at risk and how much money we are willing to lose in a day.

Our Biggest Loss

Since Aug 1 2023 our biggest loss was .86% of the the account. Our biggest drawdown in 1 day was close to 2% but we closed out the day positive.

3% RULE

If we lose 3% of the account value in one day, we are done trading for the day.

Are you ready to JOIN US!

We would be delighted to have you join us; however, we exclusively accept accredited investors. If you're ready to invest, please click the link and complete the form. Should you have any questions, feel free to contact us.